2020 CIRT Sentiment Index: First Quarter Report

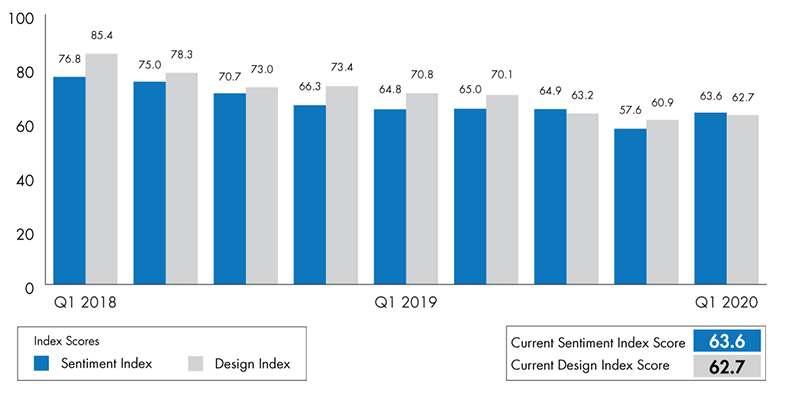

The first quarter of 2020 showed an increase in both the CIRT Sentiment Index and Design Index. The CIRT Sentiment Index grew from 57.6 in the fourth quarter of 2019 to 63.6 in the first quarter of 2020. Higher index scores suggest broadened optimism across participating firms going into 2020.

This quarter’s current issues questions polled CIRT membership on a variety of key internal metrics, including backlogs, firm capacity and hiring goals. The survey also captured open responses on challenges facing each firm in 2020.

Nearly three-quarters of participating firms reported 2019 year-end backlogs between 12 and 24 months, with just under half of respondents in the range of 12 to 18 months. Comparing backlog estimates to the prior year, most members (~57%) suggested an increase, one-third (~33%) reported little to no change, and only 10% reported decline. Similarly, more than two-thirds of CIRT member respondents indicated that their firms would be operating over 80% capacity through 2020, with the largest segment of respondents (37%) suggesting firm capacity would exceed 90%. Comparing 2019 year-end hiring goals to the prior year, most survey participants were split between increasing hiring goals or keeping them about the same (both groups at approximately ~46%). Very few respondents (8%) suggested lowering hiring goals through 2020.

Last, among the current issues topics, CIRT members were questioned about significant issues they believe will challenge their firms in 2020. Nearly two-thirds of respondents suggested labor-related concerns, with frequent mentions that attracting and hiring quality talent would be the greatest challenges. Alternatively, approximately one-third of respondents identified technology and economic/political-related challenges. Common technological themes included cyberterrorism, data analytics, prefabrication and operational optimization. Recurring economic and political themes included the 2020 election, passing of a federal infrastructure bill and increased risk of an economic downturn.

Among the segments and industries represented by CIRT’s member base, health care is projected to experience the most short-term growth across the broader construction industry, whereas industrial, transportation and manufacturing are all expected to exhibit healthy growth over the long term. Secondary segments that all stand out over the next year include health care, public works and education. Design respondents expect health care, pre-design and transportation to outperform over the next quarter and foresee long-term opportunities in transportation, industrial and health care.

Overall, respondents believe that the industrial, manufacturing and transportation construction sectors will show the most promise long-term. Public works will remain steady, and office, lodging and commercial will start to decline over the next year. Within the design industry, respondents believe that international, commercial, education and consulting planning will decline; residential will remain stable; and heavy/civil will experience growth over the long term.

CIRT SENTIMENT INDEX AND DESIGN INDEX SCORES FROM Q1 2018 TO Q1 2020

To access the full report including all charts and graphs, please download the PDF.

ABOUT THE CONSTRUCTION INDUSTRY ROUND TABLE (CIRT)

The Construction Industry Round Table (CIRT) is composed exclusively of approximately 120-125 CEOs from the leading architectural, engineering and construction firms doing business in the United States.

CIRT is the only organization that is uniquely situated as a single voice representing the richly diverse and dynamic design/construction community. First organized in 1987 as the Construction Industry Presidents’ Forum, the Forum has since been incorporated as a not-for-profit association with the mission “to be a leading force for positive change in the design/construction industry while helping members improve the overall performance of their individual companies.”

The Round Table strives to create one voice to meet the interests and needs of the design/construction community. CIRT supports its members by actively representing the industry on public policy issues, by improving the image and presence of its leading members, and by providing a forum for enhancing and developing strong management approaches through networking and peer interaction.

The Round Table’s member CEOs serve as prime sources of information, news and background on the design/construction industry and its activities. If you are interested in obtaining more information about the Construction Industry Round Table, please call 202-466-6777 or contact us by email at [email protected].

CIRT SENTIMENT INDEX

The CIRT Sentiment Index is a survey of members of the Construction Industry Round Table conducted quarterly by FMI Research, Raleigh, North Carolina. For press contact or questions about the CIRT Sentiment Index, contact Mark Casso at [email protected] or Brian Strawberry at [email protected].

All individual responses to this survey will be confidential and shared outside of FMI only in the aggregate.

All names of individuals responding to this survey will remain confidential to FMI.

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected].

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected]. Bryan Fowler is a research analyst in the strategy practice. He engages with FMI’s broad range of clients in conducting primary and secondary research to solve their most challenging strategic problems. Bryan’s primary responsibilities include market research, data analysis and private equity due diligence. Bryan can be reached at [email protected].

Bryan Fowler is a research analyst in the strategy practice. He engages with FMI’s broad range of clients in conducting primary and secondary research to solve their most challenging strategic problems. Bryan’s primary responsibilities include market research, data analysis and private equity due diligence. Bryan can be reached at [email protected].