2021 Heavy Civil Construction Index: First Quarter Report

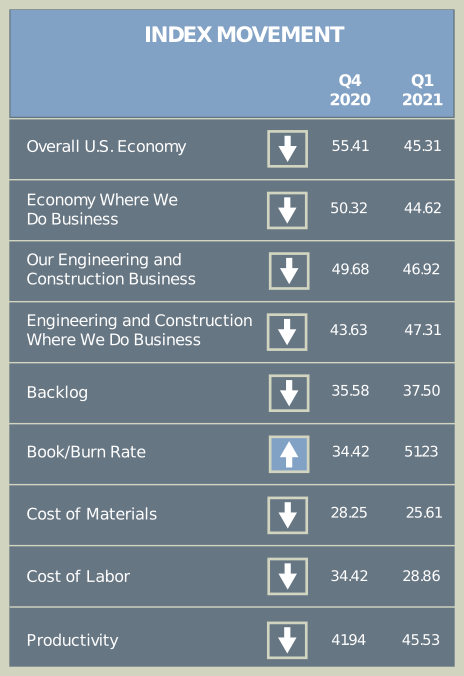

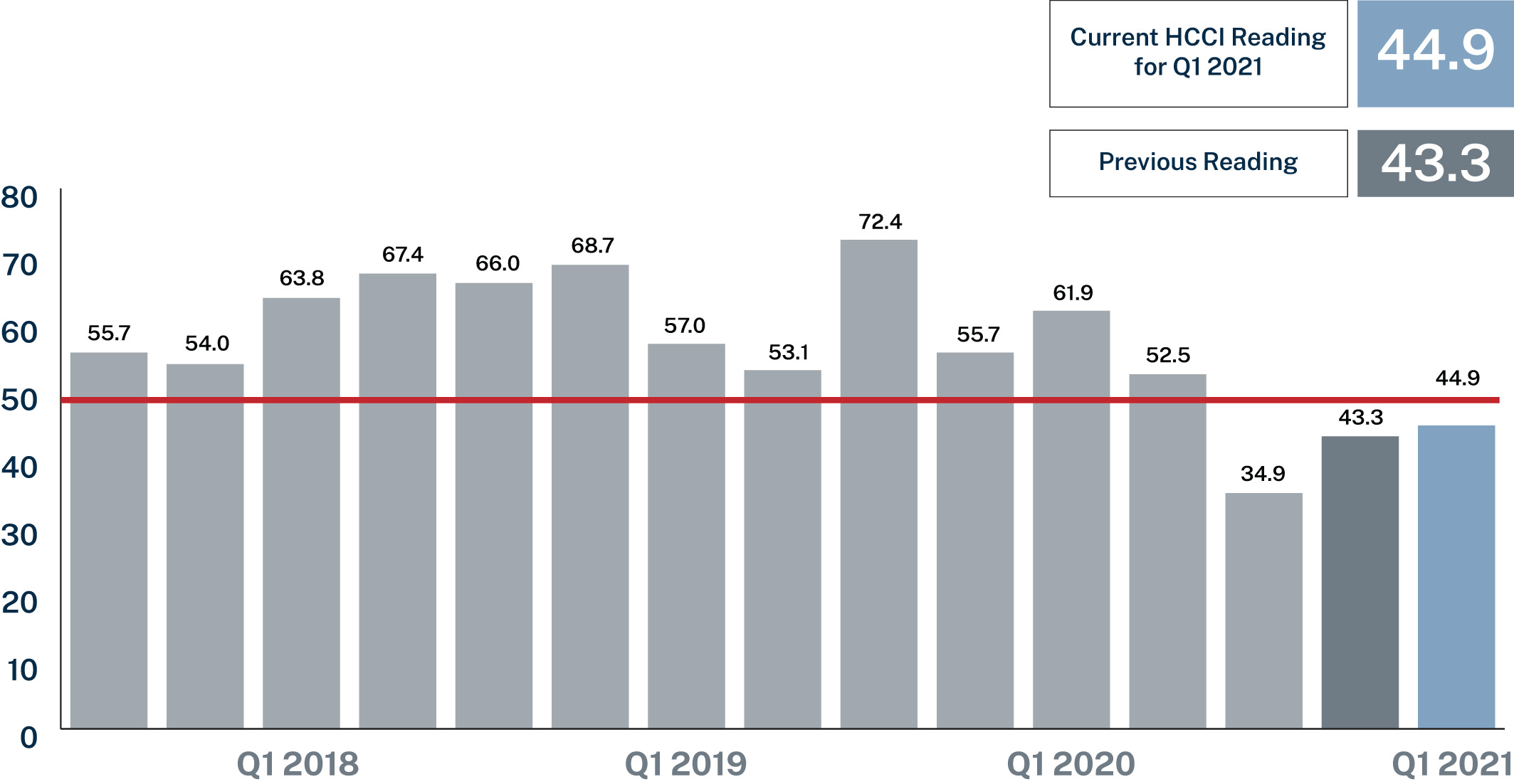

The first quarter 2021 Heavy Civil Construction Index shows improving sentiment, increasing from 43.3 to 44.9. However, the measure remains below 50, suggesting a continued pessimistic outlook. Compared to last quarter, the general U.S. and regional economic outlooks retreated, while the book-to-burn metrics improved.

Continued relaxation of government mandated closures, increased hope for improving vaccination efforts, and the prospects for ongoing and increased government investment have not been enough to counter economic anxiety.

Though it is encouraging to find most contractors adding backlog faster than they are burning it, with only one-third experiencing a decline in this ratio, the trend may be a result of slower burn rates during winter months or an urgent effort to add backlog.

Survey findings also show that 85% of respondents are seeing an increase in competition and 60% are seeing lower bid prices, raising concerns about potential panic bidding scenarios.

For current issues topics, FMI asked respondents about capacity, backlog and hiring goals for 2021.

Concerningly, more than half of respondents (51%) indicated they are operating below 80% capacity, suggesting there is a need to either add backlog or shed capacity (especially if concerns over worsening market conditions solidify).

Most contractors (85%) noted that backlog going into 2021 is about the same or higher than it was last year. More than a third of respondents (39%) indicated they had lower hiring goals than a year ago, compared to those raising goals (33%) or staying about the same (28%), perhaps due to overcapacity combined with curbed confidence.

FMI’s fourth quarter heavy civil construction forecast for transportation and highway and street segments suggests 2020 will end nearly 2% lower than 2019, followed by 3% declines in 2021 and a 1% decline in 2022.

Pullback will be led by transportation, largely due to declining air and rail investment. Upon reauthorization of a federal surface transportation bill, positive highway and street investment growth is expected to return in 2022.

HCCI scores are based on a diffusion index where scores above 50 represent improving or expanding industry conditions, a score of 50 represents conditions remaining the same, and a score below 50 represents worse conditions than last quarter (or contraction).

HEAVY CIVIL CONSTRUCTION INDEX (HCCI) Q3 2017 TO Q1 2021

To access the full report including all charts and graphs, please click below to download.

Brian Moore is a principal and strategy practice leader with FMI. Brian focuses on consulting with contractors on various strategic, organizational and operational issues. Brian works in identifying future construction trends, market conditions and competitive issues that impact strategic decisions. Brian’s clients count on him as a thought leader and trusted advisor as they plan the future of their business. He works with clients to help them develop the organizational capabilities that match their chosen strategy so they can achieve desired results. Brian can be reached at [email protected].

Brian Moore is a principal and strategy practice leader with FMI. Brian focuses on consulting with contractors on various strategic, organizational and operational issues. Brian works in identifying future construction trends, market conditions and competitive issues that impact strategic decisions. Brian’s clients count on him as a thought leader and trusted advisor as they plan the future of their business. He works with clients to help them develop the organizational capabilities that match their chosen strategy so they can achieve desired results. Brian can be reached at [email protected]. Paul Trombitas is a senior consultant with FMI’s strategy practice and works with clients across the engineering and construction industry. He is responsible for managing and delivering in-depth market insights focused on the Built Environment. He is actively involved with clients in developing market strategy, focusing on alternative project delivery methods. Paul has been quoted in multiple publications, including ENR, regarding the design-build market and maintains key stakeholder relationships that provide unparalleled industry access. Paul can be reached at [email protected].

Paul Trombitas is a senior consultant with FMI’s strategy practice and works with clients across the engineering and construction industry. He is responsible for managing and delivering in-depth market insights focused on the Built Environment. He is actively involved with clients in developing market strategy, focusing on alternative project delivery methods. Paul has been quoted in multiple publications, including ENR, regarding the design-build market and maintains key stakeholder relationships that provide unparalleled industry access. Paul can be reached at [email protected]. Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected].

Brian Strawberry is a senior economist with FMI. Brian’s expertise is in economic and statistical modeling. He leads FMI’s efforts in market sizing, forecasting, and building product/construction material pricing and consumption trends. The combination of Brian’s analytical skills and creative problem-solving abilities has proven valuable for many contractors, owners and private equity groups as well as industry associations and internal research initiatives. Brian can be reached at [email protected]. Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].

Emily Beardall is a senior analyst for FMI’s strategy practice. Emily is responsible for creating and developing tools to deliver innovative solutions for our clients. She is committed to utilizing these strategic tools to improve company performance and profitability. Emily can be reached at [email protected].