FMI’s 2019 M&A Trends for Engineering and Construction

Introduction

The Big Picture

2018 was a record year for M&A activity in the E&C industry

In last year’s M&A Trends for Engineering and Construction, we noted that demographic succession needs throughout the industry (fueled in part by baby-boomer retirements), coupled with heightened buyer interest, were creating an environment conducive to M&A activity in the engineering and construction (E&C) industry.

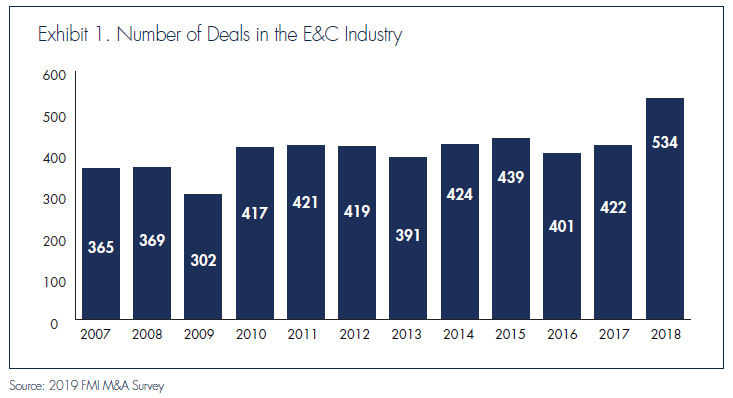

This proved to be correct; we saw a record level of deal activity in 2018. Coming out of the Great Recession, M&A activity (in terms of total deal count) in the E&C industry was relatively steady between 2010 and 2017, tracking between 390 to 440 deals annually. In 2018, 534 transactions were announced in the E&C industry, a 26.5% increase over 2017 and, by far, the highest level of activity we have ever recorded (Exhibit 1).

Looking to the near future, we expect M&A activity to remain strong but likely to return to more regular levels in 2019 and beyond. In this year’s survey, nearly 60% of all respondents indicated that acquisitions were a part of their current strategy—down from 70% in last year’s survey. While significant buyer interest remains in the market, we expect acquisition levels to return to what they were back in 2017.

Also, over half of all respondents said they were less likely to make an acquisition in 2019 than in 2018. This is in part due to the record level of activity in 2018, as many firms are digesting recent acquisitions and resetting their strategies in an altered competitive environment (see “Interesting Trends We Are Watching” below). Despite the decline in firms pursuing acquisitions, nearly two-thirds of all respondents believe M&A activity will increase in 2019, and only 4% believe it will decline (33% believe it will not change).

The Market Remains Strong

The M&A market remains quite strong for quality sellers, with plenty of appetite from both strategic buyers and private equity firms and improved valuations. Over three-quarters of all survey respondents believe that industry valuations have risen over the past 24 months, primarily due to the increased market activity and improved performance of target companies.

For most firms that have made acquisitions a part of their current strategy, the primary drivers are:

- The desire to grow and diversify their businesses.

- The ability to expand services/capabilities.

- The need to tackle a shortage of qualified labor.

As one survey respondent noted, acquisitions are “An opportunity to acquire talent that is increasingly hard to find.” Interestingly, the shortage of industry talent can also be a reason some companies may be more hesitant to make a significant acquisition. As another respondent replied, “We do not have enough young leader talent to take on a new acquisition of significant size.”

Survey respondents believe the sectors most ripe for acquisition activity in 2019 are civil infrastructure and industrial—both areas where the need to self-perform (and access to labor) makes organic growth more challenging. The expected interest in civil infrastructure is particularly interesting, as we noticed buyer appetite in this sector wane during the second half of 2018, once it became clear that the administration would not pass a federal infrastructure bill that year.

Finally, for those firms looking to expand geographically (80% of all respondents), the regions of most interest are western, southwestern and southeastern U.S. These and other trends noted in the survey should result in continued M&A activity in the E&C industry for 2019 (albeit reduced from 2018 levels).

Interesting Trends We Are Watching

Every year we like to point out a few interesting trends and the impact they may have on M&A activity. This is not meant to be taken as the largest trends (though some are significant), but instead these are interesting observations from our viewpoint in the market.

1. Continued Consolidation Impacts Competitive Landscape

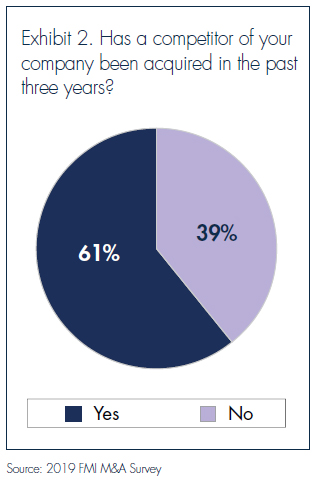

The level of M&A activity over the past 10 years (and most notably in 2018) has resulted in a very different E&C landscape than the one we experienced post-Great Recession. In fact, nearly two-thirds of our survey respondents said that one of their competitors had been acquired in the past three years (Exhibit 2).

Beginning in 2010, the E&C industry experienced nearly a decade of sustained M&A activity. Looking back at the largest E&C firms in 2009 is a history lesson, but not indicative of the competitive landscape today. That’s because numerous firms have either merged or are now operating under new ownership (even if their brand remains in the market). Take for example the following names, all of which no longer exist as independent entities:

Beginning in 2010, the E&C industry experienced nearly a decade of sustained M&A activity. Looking back at the largest E&C firms in 2009 is a history lesson, but not indicative of the competitive landscape today. That’s because numerous firms have either merged or are now operating under new ownership (even if their brand remains in the market). Take for example the following names, all of which no longer exist as independent entities:

-

- URS Corporation

- CH2M

- MWH Global

- Parsons Brinckerhoff

- Layne Christensen Company

In 2018 we continued to see notable examples of E&C consolidation as firms addressed customers’ desire for large firms offering an integrated, singlesource solution. This is not a new trend (see our M&A Trends in 2017 and 2018), but it’s interesting in that we’ve seen the trend propagate throughout the industry and not just among the largest E&C providers (e.g., 2018 merger between McDermott and CB&I). Also, the strategic drivers now referenced are not just about creating a better solution for clients but also a better platform for employees. Take for example two deals in 2018:

-

- Granite’s acquisition of Layne Christensen

- Primoris’ acquisition of Willbros

Both are examples of a public company acquiring another public company to expand its portfolio of services and create a larger organization that offers more comprehensive solutions to its clients and greater prospects for its employees. In a competitive labor environment, providing a platform for growth is as important to employee retention as it is to shareholder value and client satisfaction. As Michael J. Caliel, president and CEO of Layne Christensen, said when announcing the sale to Granite, “Our employees will benefit from the upside and strong growth prospects of being part of a larger infrastructure company.”

2. Some Buyers Pause to Digest Recent Activity, While Some May Try to Catch Up

As mentioned in “The Big Picture,” our 2019 survey showed that over half of all respondents said they were less likely to make an acquisition in 2019 than in 2018. This is being driven in part by the nearly 20% of responding companies that made an acquisition in the past year (plus the over 40% of firms that have made an acquisition in the past four years).

As one survey respondent said when asked why he/she was less likely to make an acquisition in 2019, “We’ve made four acquisitions in four years; we’ll likely take a break this year.” Many firms throughout the industry have addressed strategic needs through acquisitions in recent years, and now some are hitting pause as they work on integration and reassess corporate strategies. This strategic reassessment is also resulting in current and future M&A activity (see next topic).

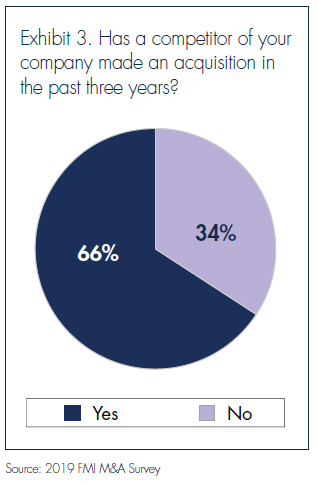

However, as noted above, the recent M&A activity has changed the competitive landscape. Two-thirds of all survey respondents indicated that at least one of their competitors had made an acquisition in the past three years (Exhibit 3).

In our discussions, we continue to see significant buyer interest in the market, with some of that interest being driven by the need to add capabilities and scale in order to remain competitive. This is becoming critical as competitors acquisitively grow their own capabilities and scale. As we have noted in previous reports, the E&C industry has undergone a competitive shift, resulting in a bifurcation between large, integrated providers and smaller niche firms in many sectors. As a result, firms that are not growing alongside competitors risk being lost in the middle of these two poles. Much like we’ve seen just after other periods of significant M&A activity, we would expect some “afterburn effect,” where firms that were unsuccessful or missed out on opportunities in 2018 pursue similar businesses or strategies in 2019.

3. Revised Strategies Leading to Corporate Divestiture Activity

Across the industry we are seeing firms reassess their current strategies and focus on core strengths and capabilities. As a result, many firms are now considering divesting noncore assets or businesses that don’t align with the revised corporate strategy. Take Jacobs’ announced divestiture of its energy, chemicals and resources business to WorleyParsons ($3.3 billion transaction), for example. This transaction—along with the acquisition of CH2M—accelerated Jacobs’ focus on “delivering solutions for a more connected, sustainable world.” As Jacobs’ chairman and CEO, Steve Demetriou, said, “This transaction marks an inflection point in our portfolio transformation focused on more consistent, higher-margin growth as a leader solving the world’s critical challenges.”

Another example in 2018 was Stantec’s divestiture of MWH Constructors, a leading design-build contractor serving the water/wastewater markets that was acquired as part of Stantec’s 2016 acquisition of MWH. This divestiture was the result of Stantec’s strategic review of its construction services in early 2018. “For Stantec, 2018 was a year of transition as we returned to our core business as a pure-play design consulting firm,” said Gord Johnston, Stantec’s president and CEO.

Going forward, we expect more firms to take advantage of existing strong market conditions and prepare themselves for future economic uncertainty by focusing on core strengths and capabilities.

Rick Tison, principal and strategy practice leader with FMI, states, “We are seeing more companies explore their options for divesting noncore assets while the market is strong in preparation for potential economic uncertainty in the next one to three years.”

4. Sustained Private Equity Activity, Driven in Part by Growing Platforms and Exit Activity

Private equity activity continues to be a key driver in overall M&A activity in the E&C industry. While the number of new platform acquisitions in 2018 (private equity firms acquiring a business on a standalone basis) aligned with the past five years of activity, FMI tracked a sizable increase in the number of add-on deals (acquisitions made by private equity-owned businesses) within our sector. This is a result of firms executing on buy-and-build strategies across various subindustries, such as HVAC and refrigeration services, design and consulting services, utility construction and industrial services.

In addition to the number of private equity firms making acquisitions (either as platform or add-on transactions), private equity firms have also taken advantage of the strong M&A market to exit investments, including to other private equity firms. Examples in 2018 include:

-

- Inland Pipe Rehabilitation LLC sale to J.F. Lehman and Company, LLC from Strength Capital

- Artisan Design Group, Inc. sale to The Sterling Group, L.P. from Dunes Point Capital, LLC

- Tecta America Corp. sale to Altas Partners LP from ONCAP

- PowerTeam Services sale to Clayton, Dubilier & Rice Inc. from Kelso & Company

- Shermco Industries, Inc. sale to Gryphon Investors from GFI Energy Ventures, Inc.

- CHA Consulting, Inc. sale to First Reserve Corporation from Long Point Capital

5. Continued Interest in Building Services

Since the Great Recession, we have witnessed a period of sustained growth throughout the construction industry. This has primarily been driven by both residential and nonresidential building construction. Over the past five years, $3.2 trillion of building construction has been put in place in the U.S. and Canada (nonresidential and multifamily sectors). This doesn’t factor in the $1.4 trillion of single-family construction put in place. Additionally, the buildings that are put in place are becoming more complex, as owners and occupants (including the millennial workforce) demand more from their workplaces, homes and other environments. The required maintenance of new systems put in place, as well as the need to upgrade or replace existing systems, creates significant opportunities for construction and service providers. This has resulted in significant M&A activity and sustained acquisition interest for providers of services to the building environment.

This also builds on the vertical integration trend within the building sector, including equipment manufacturers and building technology providers looking to expand service capabilities, and the convergence of energy service companies (or ESCOs) and traditional mechanical and electrical construction and services. “More and more, we are seeing acquirers target those specialty contractors who have demonstrated success in navigating the changing IT landscape within construction,” says Ryan Foley, managing director at FMI Capital Advisors. “Those MEPs who embrace BIM, complex data center expertise and prefab capabilities have become hot prospects for interested buyers in the built environment.”

6. E&C Firms Invest in Technological Solutions

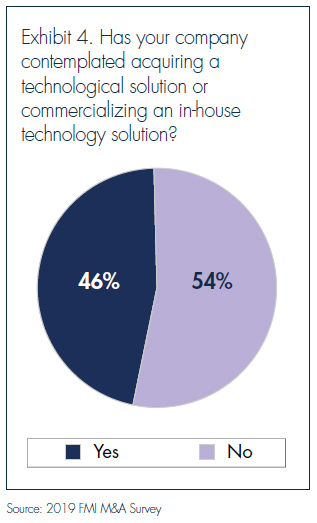

A new question we asked in the survey this year was: “Has your company contemplated acquiring a technological solution or commercializing an in-house technology solution?” Nearly half of all respondents to the survey this year answered “yes” to the question (Exhibit 4).

A new question we asked in the survey this year was: “Has your company contemplated acquiring a technological solution or commercializing an in-house technology solution?” Nearly half of all respondents to the survey this year answered “yes” to the question (Exhibit 4).

This is not surprising, as technology has begun to emerge as a leading differentiator for E&C companies. It also an area where venture capital has started to take notice. Funding for construction technology startups based in the U.S. reached nearly $3.1 billion in 2018, a 324% increase over 2017.1 While most of this investment was made in firms serving E&C companies (e.g., ERP software, 3D design software, etc.), some was also allocated to companies that are attempting to disrupt the way infrastructure or buildings are actually constructed (see below how Katerra raised $865 million in a Series D round in January 2018). This dynamic has led many firms to consider bringing a technology solution in-house (as a competitive differentiator) or monetizing an in-house technology with third-party commercial application.

The convergence of technology and construction is also changing some firms’ strategies, with implications for their M&A course. As an example, the evolving role technology is playing in the federal and infrastructure sectors has resulted in a revised strategy for Jacobs Engineering, leading to the acquisition of CH2M as well as Blue Canopy Group, LLC (provider of cloud, big data analytics, data science, and enterprise information technology consultancy and services) and the divestiture of its energy, chemicals and resources business. Across the industry, firms are considering the impact technology has on the delivery of construction and the services they can offer to clients, which is impacting acquisition strategies.

7. Evolving Delivery Methods in Building Construction

In previous reports, we have discussed evolving delivery methods within the civil and industrial sectors and how the convergence of design and construction in those markets led to M&A activity (and, in some cases, subsequent divestitures). We are beginning to see that same evolution taking place in the building sector. According to FMI’s “2018 Design-Build Utilization” report, the project delivery method will comprise 44% of construction spending between 2018 and 2021. During this time such construction spending will grow by 18% and reach over $320 billion, including growth in segments which have not traditionally leveraged the delivery method (e.g., education, commercial and office).

Considering this, some construction companies are exploring strategic partnerships or acquisitions as a competitive advantage. “With broader acceptance of integrated delivery methods across a widening range of markets, more contractors are turning to acquisitions to bring design capabilities in-house. This strategy allows firms to pursue the increased profit potential from design-build, but can also provide them access to the project owner at an earlier stage to influence the design and construction process,” explains Greg Powell, managing director and lead of FMI Capital Advisors’ Engineering, Environmental & Architecture Services practice.

This trend toward in-house design was also confirmed in the most recent AGC/FMI Risk Study, in which more than 43% of contractors say they’re going to do more in-house design compared to just 38% in 2018.2 This is a 5% increase in the number of organizations that grew their in-house design capabilities over the prior 12 months, with an additional 25% of organizations thinking about increasing their design capabilities in the near future (but not yet actually doing it).

Additionally, several firms are taking vertical integration in the building sector even further. Katerra, whose most recent valuation is rumored to be $4 billion, is creating a vertically integrated model of design, material supply, manufacturing, logistics and assembly to shorten time and lessen the costs from building construction. In 2018 Katerra acquired four companies in North America (two general contractors and two architectural companies) to provide architectural and construction expertise and delivery in an effort to offer an end-to-end solution for building construction.

Similarly, on the residential side, Asahi Kasei Homes, a Japanese-based provider of order-built unit homes, acquired Erikson Framing Operations, LLC (from Atlas Holdings, a private equity firm, reinforcing a previously discussed trend). Erikson is a provider of prefabricated building components focused on streamlining the construction process by prefabricating components at a factory to be shipped and erected at the building site. Both examples highlight the impact that trends we have been discussing for years—off-site construction, vertical integration of the supply chain—are having on the M&A landscape for E&C companies.

1 Mary Ann Azevedo. “Investor momentum builds for construction tech.” TechCrunch. 02/16/2019.

2 2019 AGC/FMI Risk Management Survey.